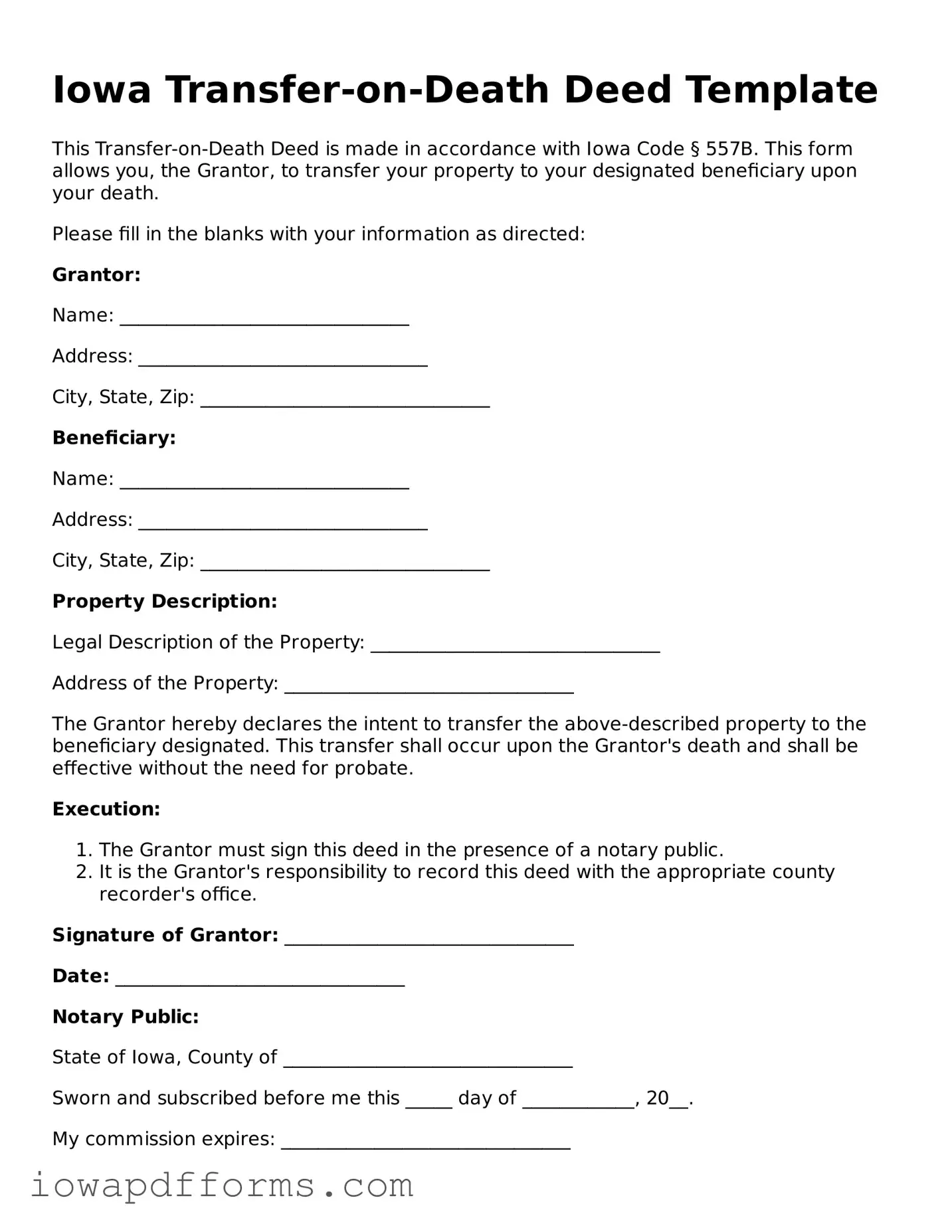

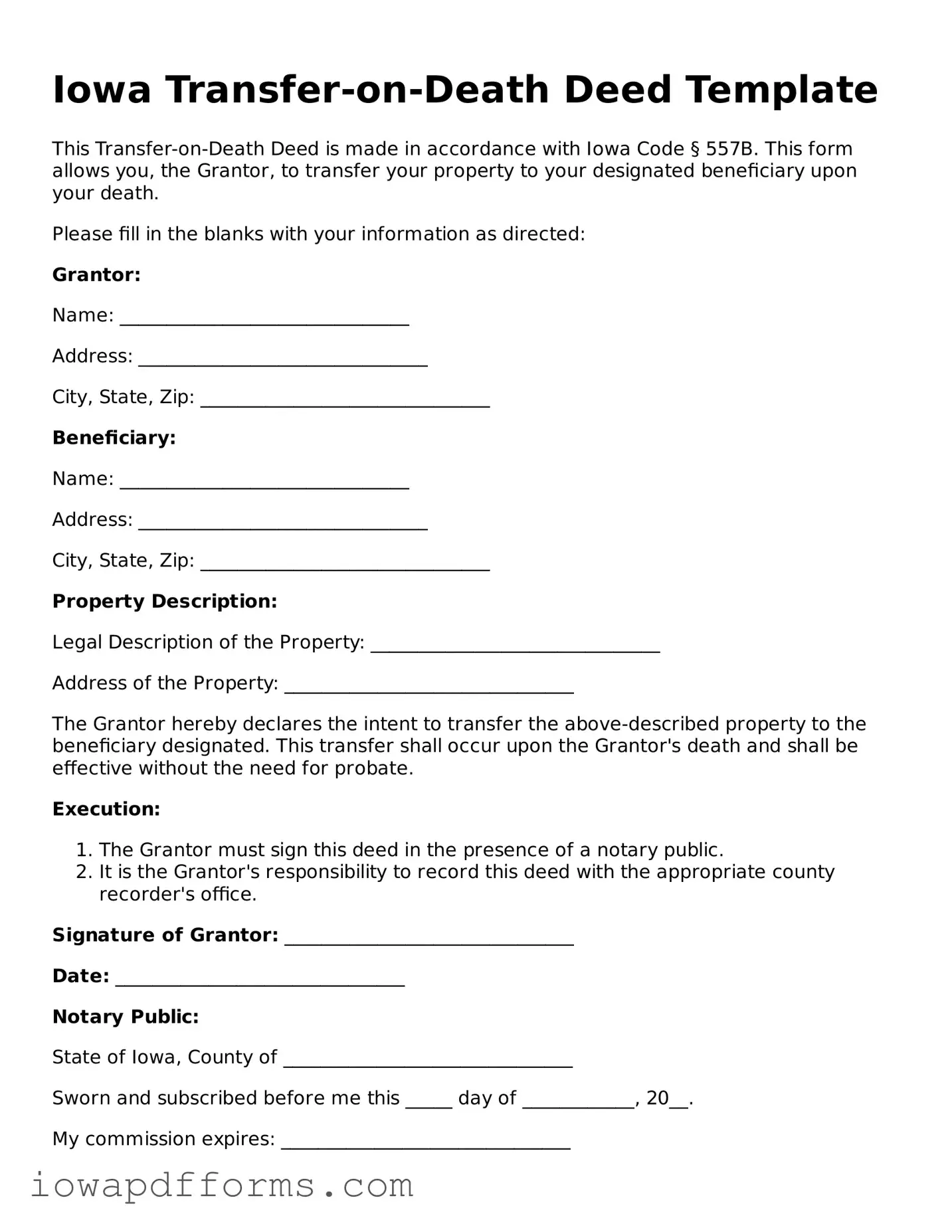

Blank Transfer-on-Death Deed Form for the State of Iowa

The Iowa Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This straightforward approach simplifies the transfer process and ensures that the property passes directly to the heirs. Understanding this deed can help individuals plan their estate effectively and avoid potential complications for their loved ones.

Fill Out This Document Now

Blank Transfer-on-Death Deed Form for the State of Iowa

Fill Out This Document Now

Fill Out This Document Now

or

Free Transfer-on-Death Deed

Fast and easy form completion

Edit, save, download — complete Transfer-on-Death Deed online today.