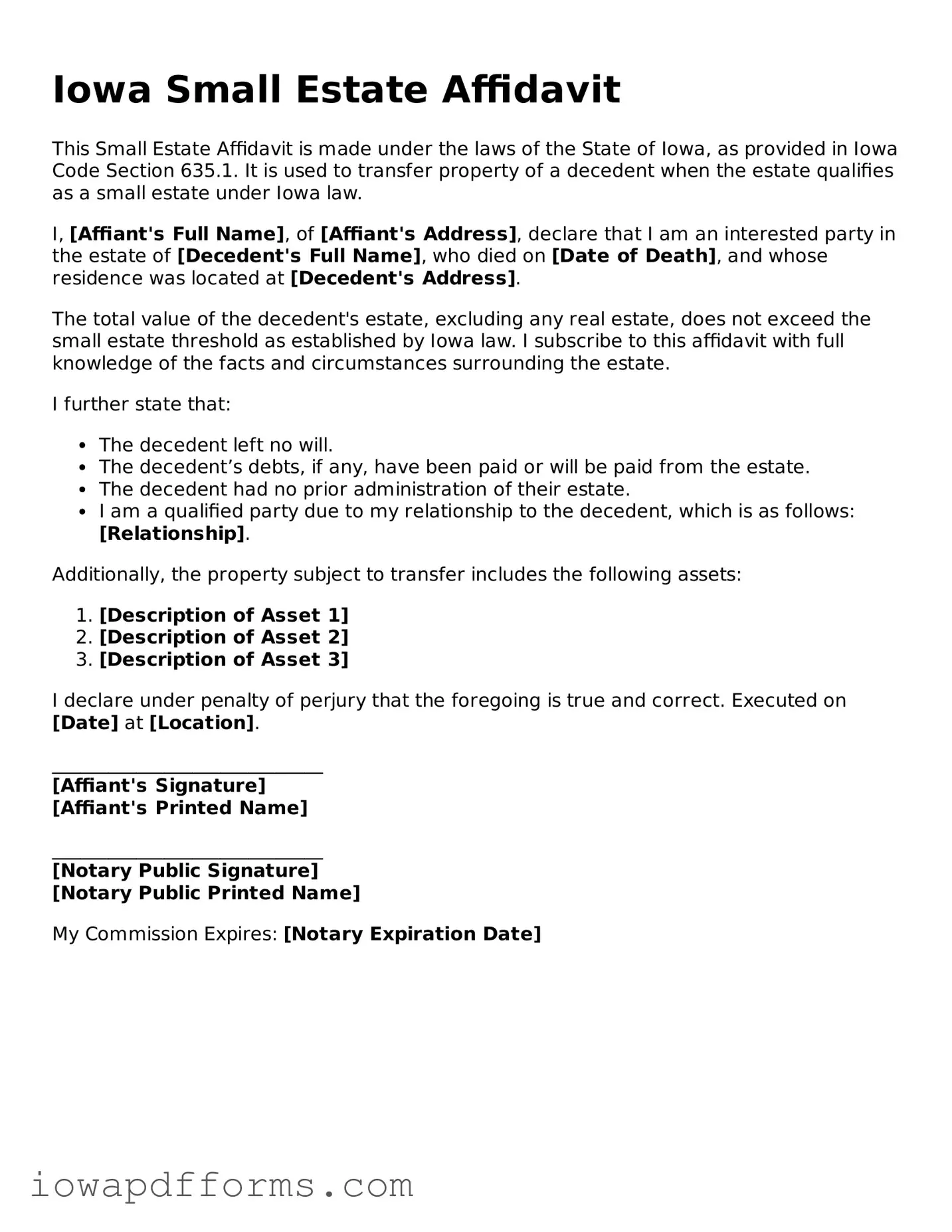

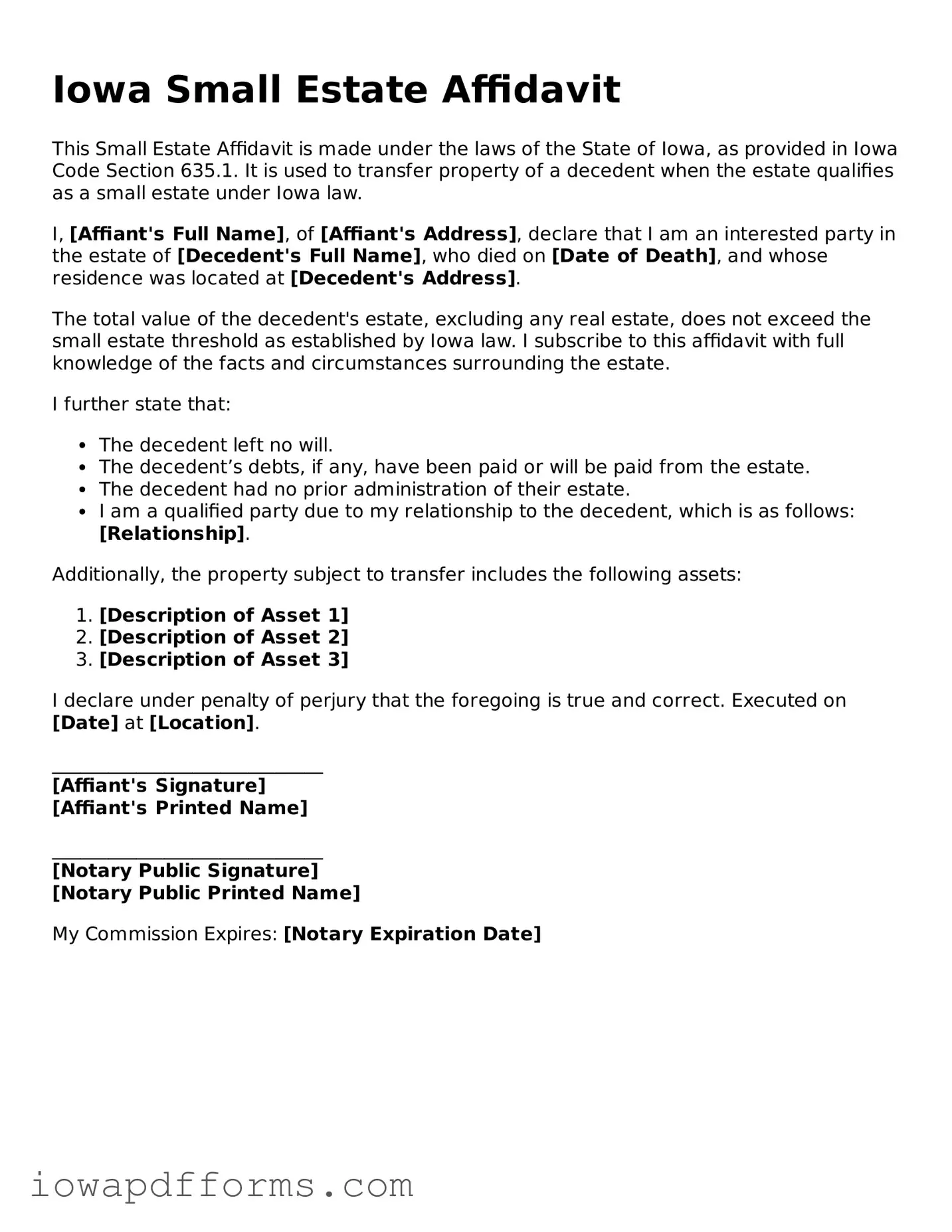

Blank Small Estate Affidavit Form for the State of Iowa

The Iowa Small Estate Affidavit is a legal document that allows individuals to claim property from a deceased person's estate without going through the lengthy probate process. This form simplifies the transfer of assets for estates valued below a certain threshold, making it accessible for those dealing with the loss of a loved one. Understanding how to properly use this affidavit can facilitate a smoother transition during a challenging time.

Fill Out This Document Now

Blank Small Estate Affidavit Form for the State of Iowa

Fill Out This Document Now

Fill Out This Document Now

or

Free Small Estate Affidavit

Fast and easy form completion

Edit, save, download — complete Small Estate Affidavit online today.