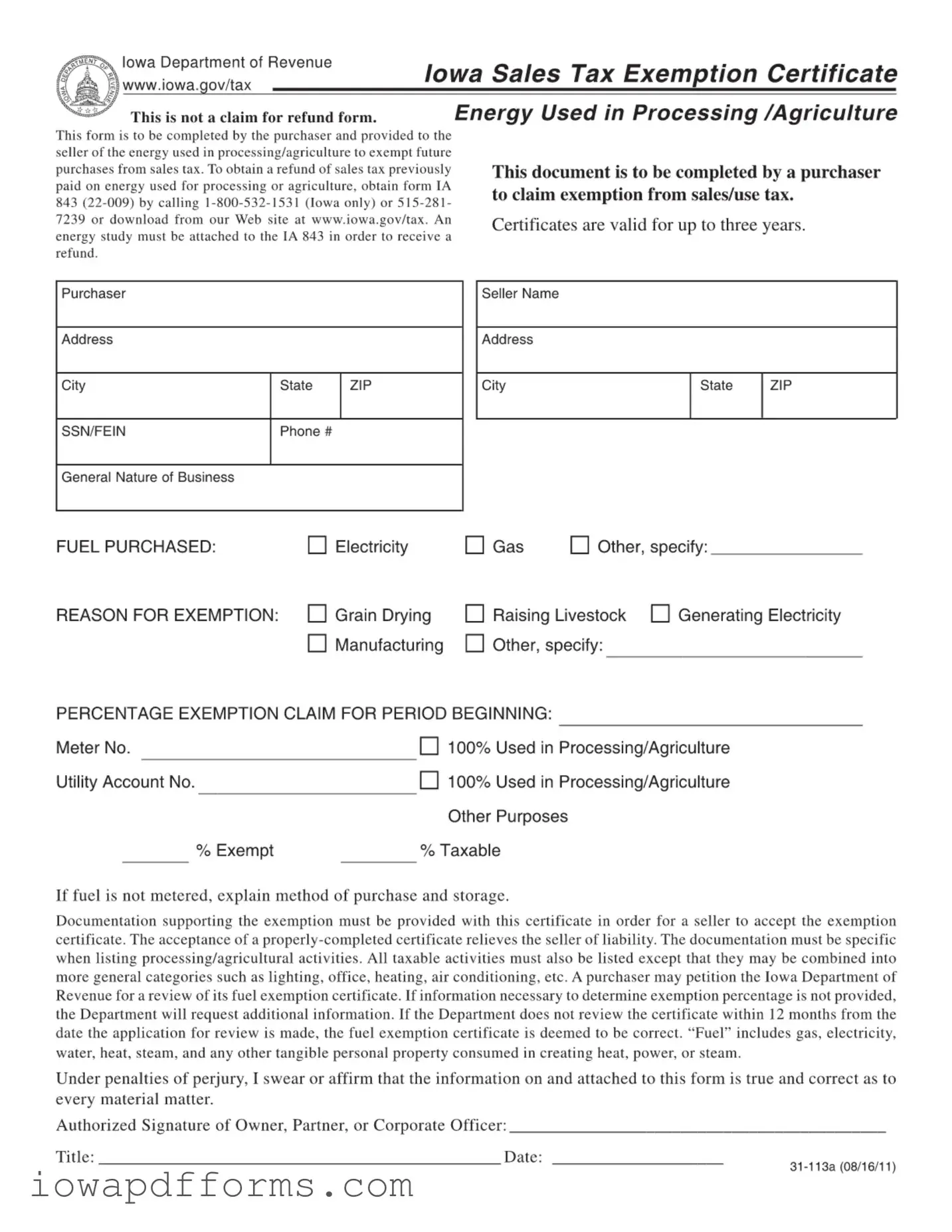

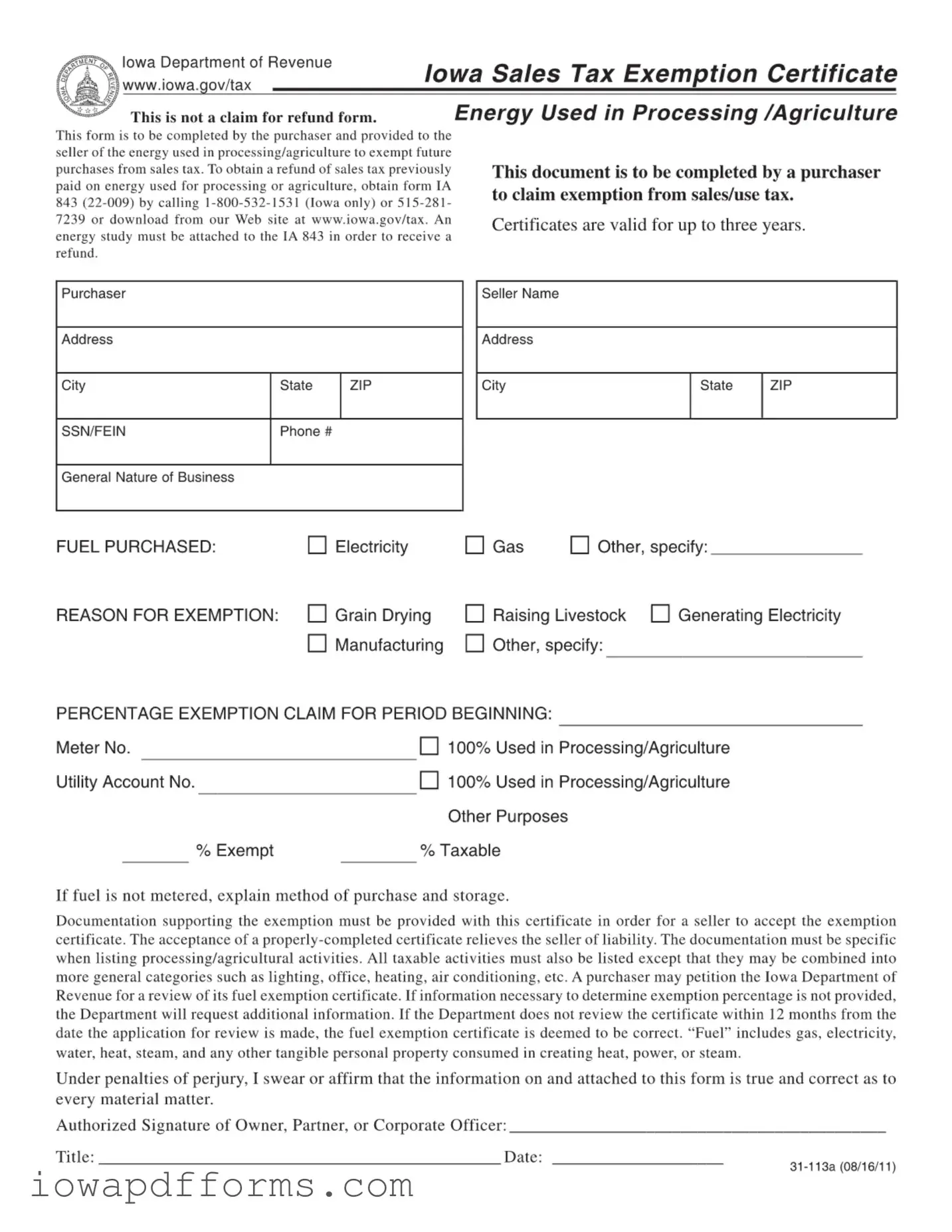

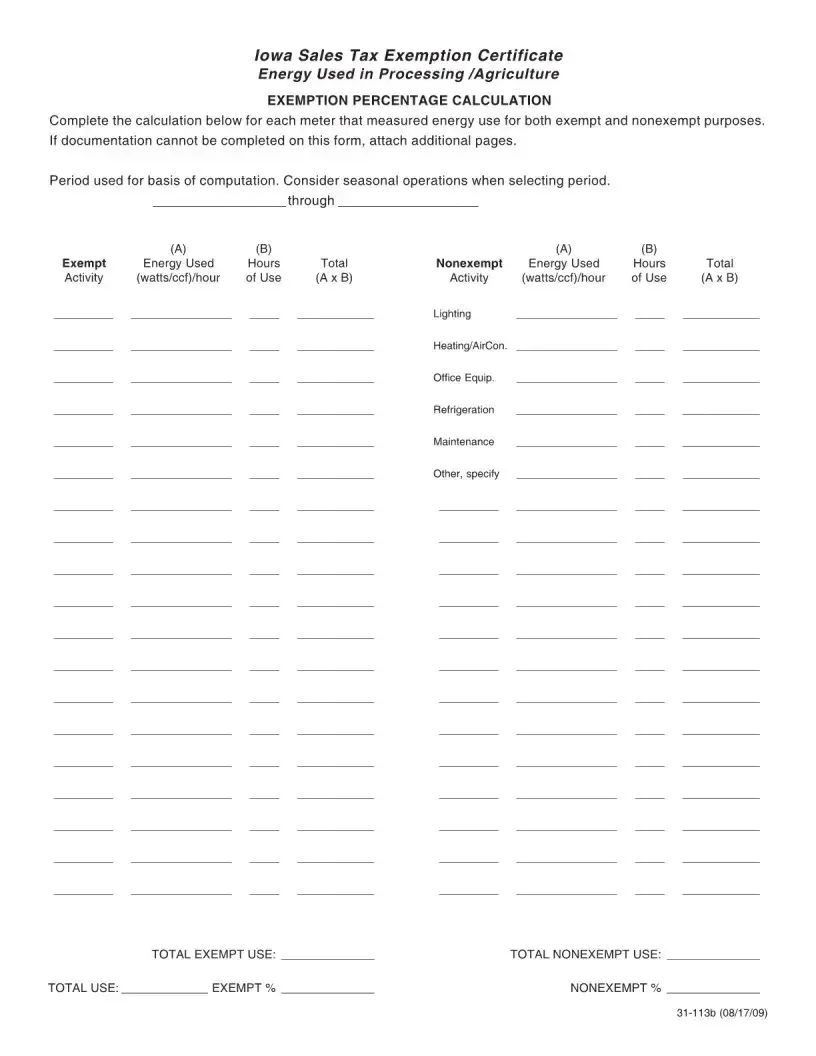

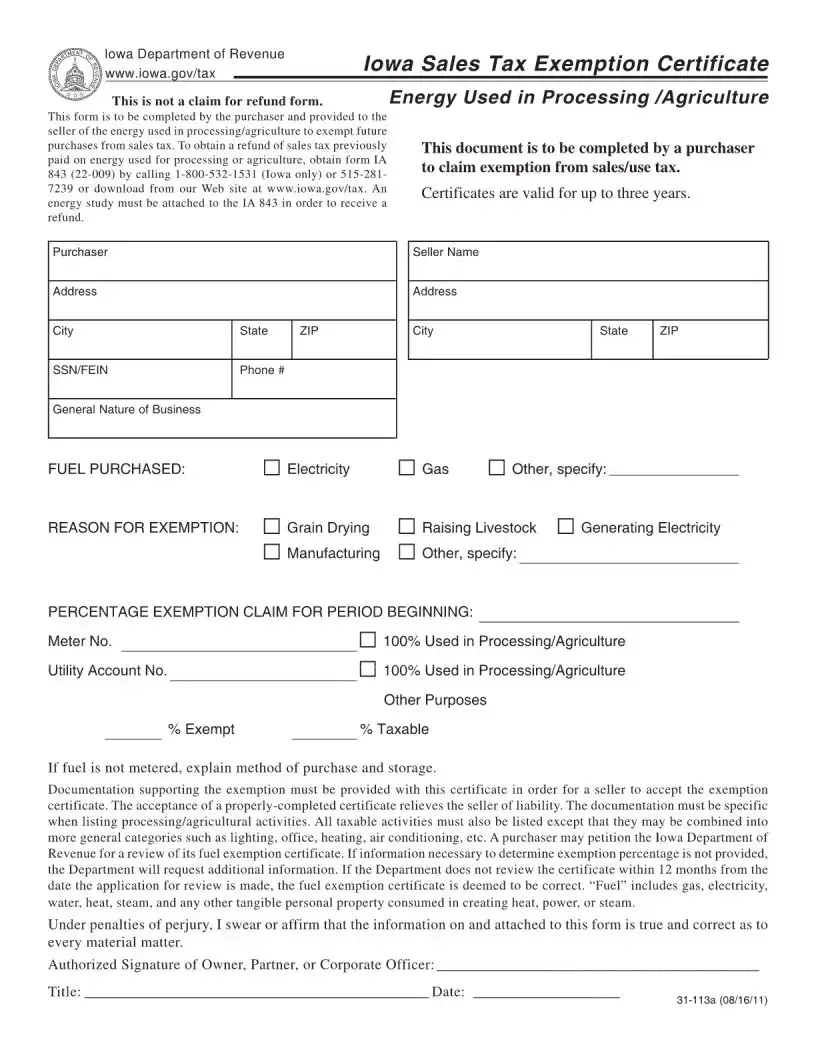

The Iowa Sales Tax Exemption Certificate is a document that allows purchasers to claim exemption from sales tax for specific types of purchases, similar to the Iowa Resale Certificate. This certificate is particularly focused on energy used in processing and agriculture. Just as the Iowa Resale Certificate is used to exempt sales tax for goods intended for resale, the Sales Tax Exemption Certificate is designed for those who utilize energy in agricultural or processing activities. Both documents require the purchaser to provide information about their business and the specific nature of their purchases, ensuring that sellers can accept these certificates without incurring tax liabilities.

The Exempt Use Certificate is another similar document, often used in various states to exempt certain purchases from sales tax. This certificate is typically used for items that will not be subject to sales tax because they are intended for specific exempt uses. Like the Iowa Resale Certificate, it requires detailed information about the purchaser and the intended use of the items purchased. Both certificates serve to protect sellers from tax liabilities while allowing purchasers to benefit from tax exemptions, thereby streamlining the sales process for eligible transactions.

The Direct Pay Permit is a document that allows businesses to pay sales tax directly to the state rather than to the seller at the time of purchase. This is similar to the Iowa Resale Certificate in that it facilitates tax-exempt purchases. Businesses that hold a Direct Pay Permit can buy goods without paying sales tax upfront, provided they will report and remit the appropriate tax later. This arrangement simplifies the purchasing process for businesses and helps them manage their tax obligations more effectively, just as the Resale Certificate does for resellers.

The Manufacturer’s Exemption Certificate is used by manufacturers to claim exemption from sales tax on materials and supplies that will be incorporated into a finished product. This certificate is akin to the Iowa Resale Certificate in that both are utilized to exempt purchases from sales tax. Manufacturers must provide information about their production processes and the specific items they are purchasing, ensuring that sellers can validate the exemption. Both documents aim to reduce the tax burden on businesses engaged in production and resale activities.

The Texas TREC Residential Contract form is crucial for ensuring clarity in real estate transactions, providing key details that help both buyers and sellers navigate the process smoothly. To learn more and access this important document, visit Texas Documents.

The Agricultural Exemption Certificate is a document specifically designed for farmers and agricultural producers to claim exemptions on purchases related to farming activities. This certificate is similar to the Iowa Resale Certificate as it allows for tax-free purchases of items that will be used in agricultural production. Just like the Resale Certificate, it requires the purchaser to provide details about their business and the nature of their purchases, ensuring that sellers can confidently accept the certificate without tax liability.

The Nonprofit Organization Exemption Certificate allows qualifying nonprofit organizations to make tax-exempt purchases for their charitable activities. This document shares similarities with the Iowa Resale Certificate in that it provides a means for organizations to avoid paying sales tax on items essential to their mission. Both certificates require the organization to furnish information about their status and the intended use of the purchased items, which helps sellers verify the legitimacy of the exemption and protects them from potential tax issues.