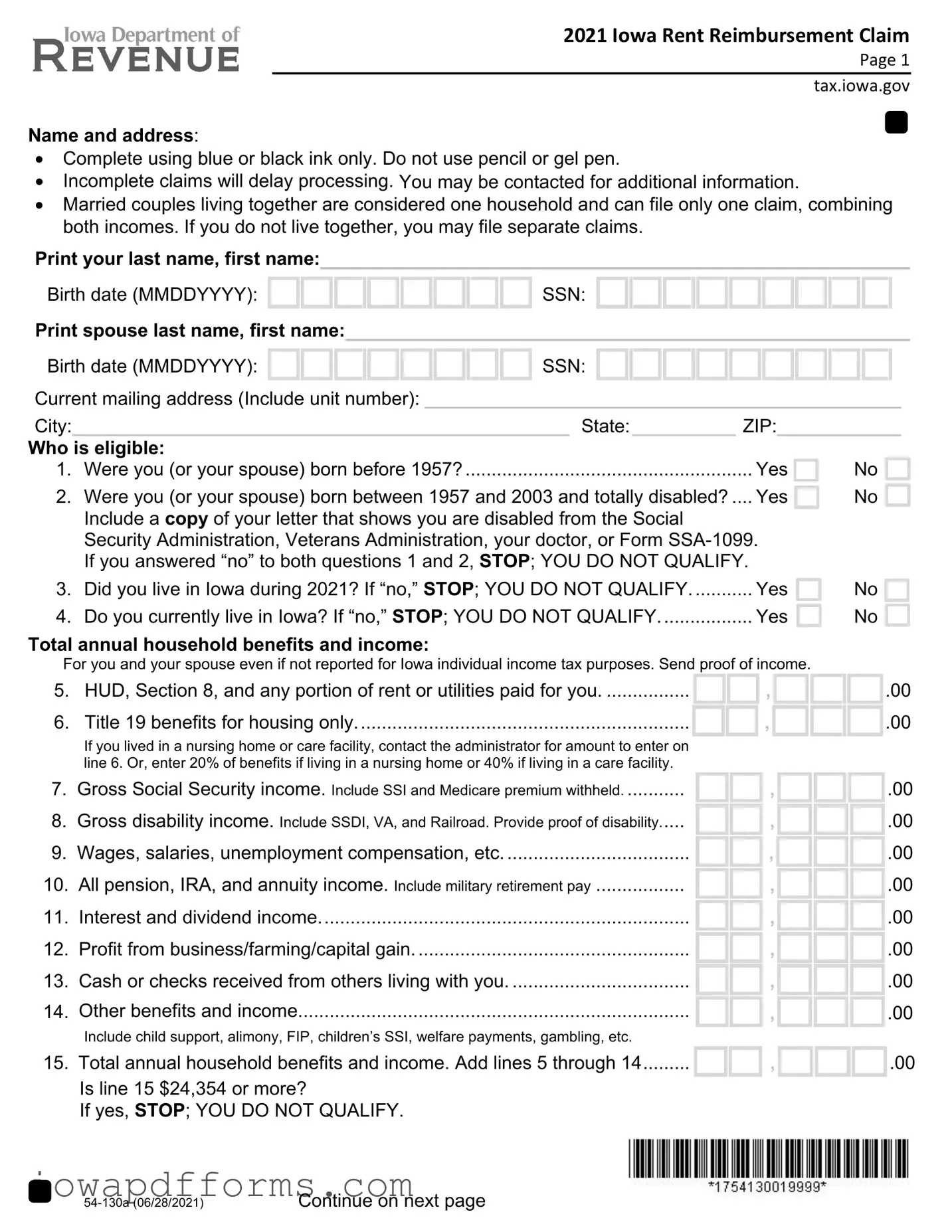

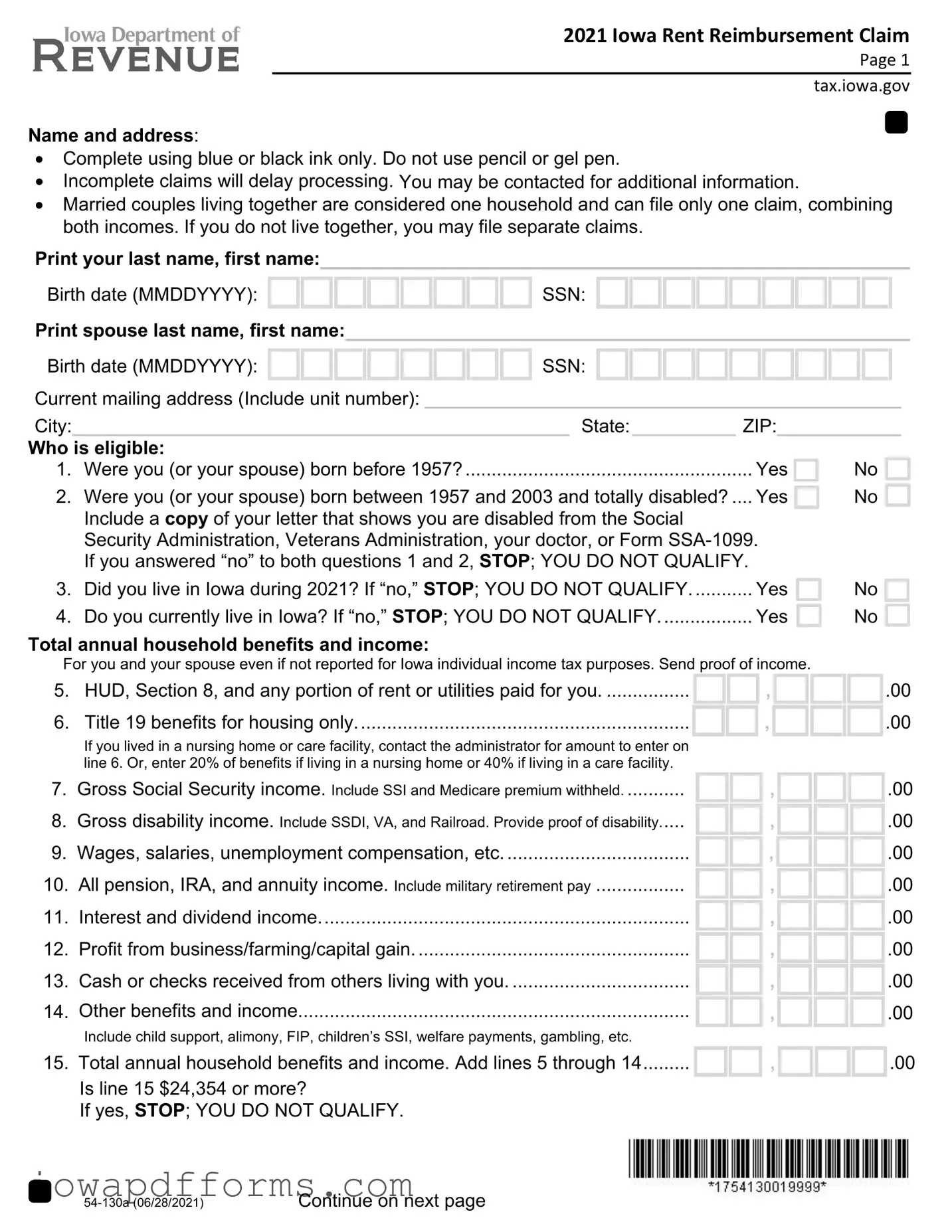

Fill in Your Iowa Renters Rebate Template

The Iowa Renters Rebate form is a document that allows eligible residents of Iowa to claim a rebate for a portion of their rent paid during the previous year. This program is designed to provide financial assistance to low-income renters, particularly those who are elderly or disabled. Understanding the requirements and process for completing this form can help ensure that you receive the benefits for which you qualify.

Fill Out This Document Now

Fill in Your Iowa Renters Rebate Template

Fill Out This Document Now

Fill Out This Document Now

or

Free Iowa Renters Rebate

Fast and easy form completion

Edit, save, download — complete Iowa Renters Rebate online today.