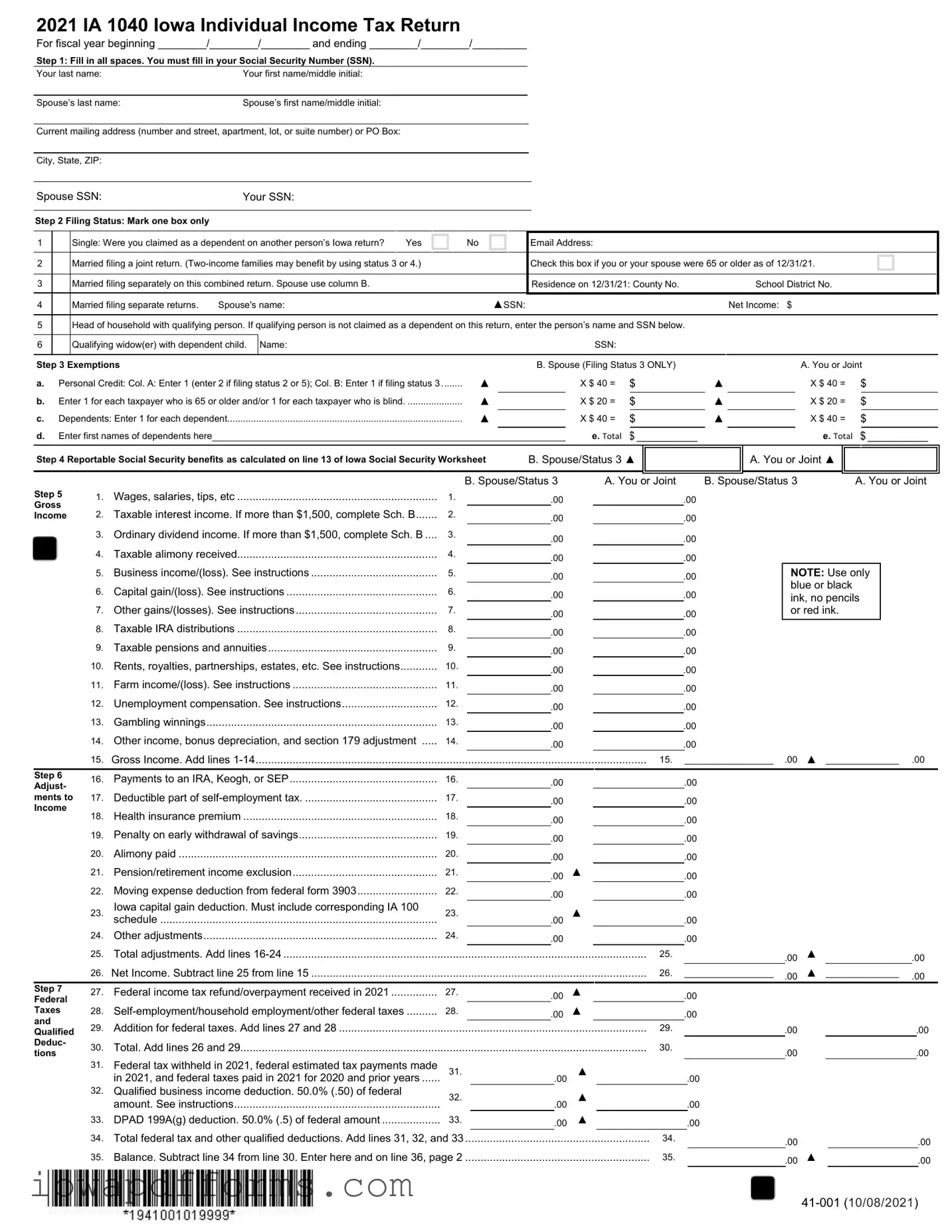

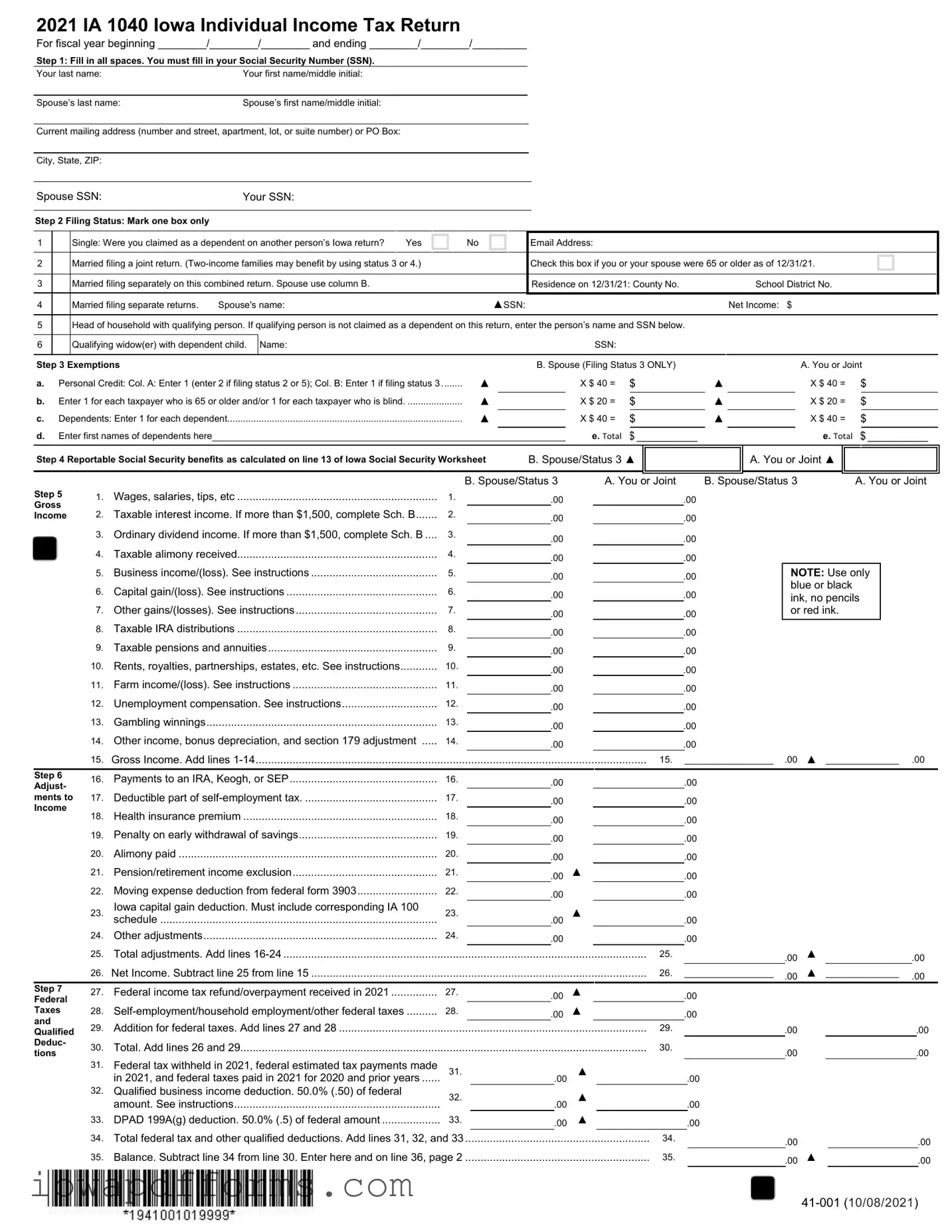

The Iowa Income Tax form shares similarities with the Federal Form 1040, which is the standard individual income tax return used in the United States. Both forms require taxpayers to provide personal information, including Social Security numbers and filing status. They also have sections dedicated to reporting income from various sources, such as wages, dividends, and pensions. The forms guide users through calculating taxable income, deductions, and credits, ultimately leading to the determination of tax owed or refunds due. This parallel structure allows taxpayers to understand their obligations under both state and federal tax laws.

Another document comparable to the Iowa Income Tax form is the state-specific tax return for Illinois, known as the IL-1040. Similar to the Iowa form, the IL-1040 requires personal details and income reporting. It also includes sections for exemptions, deductions, and tax credits. Both forms serve the same purpose of calculating the taxpayer's liability to the respective state and require similar information to ensure compliance with state tax regulations. This consistency across state forms aids taxpayers who may move between states or have income in multiple jurisdictions.

In addition to the various tax forms discussed, it is also crucial for mobile home transactions to adhere to legal requirements, and the New York Mobile Home Bill of Sale form serves as a key document in this regard. This form records the transfer of ownership of a mobile home, ensuring that the transaction is recognized under state laws. For those looking to simplify this process, you can access the Mobile Home Bill of Sale form which outlines all necessary details for a smooth transfer.

The California Resident Income Tax Return, Form 540, is another document that mirrors the Iowa Income Tax form. Both forms require comprehensive personal information and allow taxpayers to report income from various sources. They also provide options for standard or itemized deductions. Like the Iowa form, California’s Form 540 includes sections for calculating tax credits and determining the final tax liability or refund. The structural similarities make it easier for taxpayers to navigate their responsibilities across different states.

The New York State Resident Income Tax Return, known as Form IT-201, also exhibits similarities to the Iowa form. Both forms require the taxpayer to disclose personal information, including filing status and dependents. They have sections dedicated to income reporting and adjustments, as well as credits that can reduce the overall tax liability. By following a similar format, these forms facilitate the tax filing process for individuals residing in different states while adhering to their respective tax laws.

Lastly, the Texas Franchise Tax Report, while serving a different purpose, shares some structural similarities with the Iowa Income Tax form. Both documents require detailed reporting of income and deductions. Although the Texas Franchise Tax applies primarily to businesses rather than individuals, the necessity for accurate financial reporting and compliance with tax obligations is a common thread. This highlights the importance of clarity and consistency in tax documentation across various tax forms, whether for individuals or businesses.