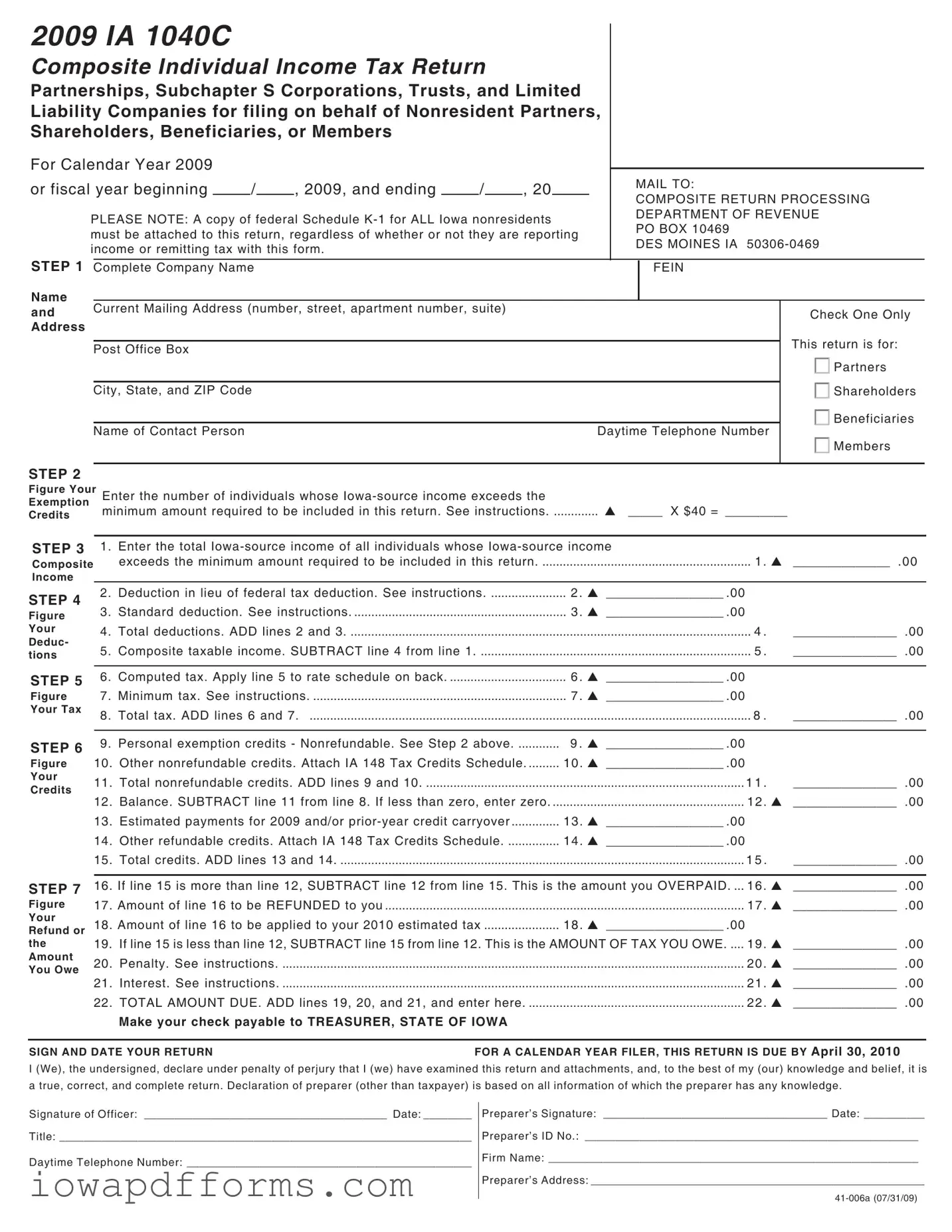

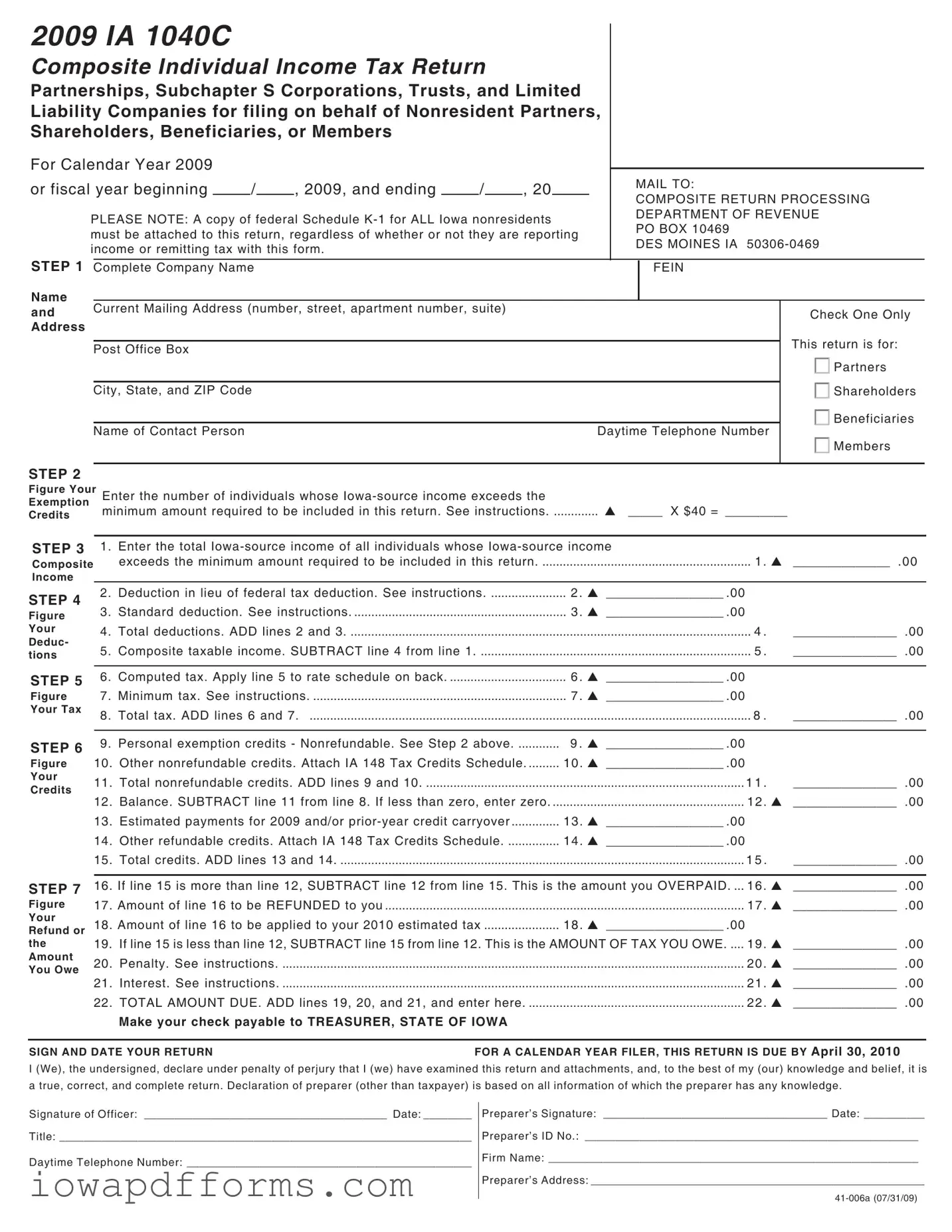

The Iowa IA 1040C form is similar to the IRS Form 1065, which is used for partnerships. Both forms allow partnerships to report income, deductions, and credits for their members. The IA 1040C is specifically designed for nonresident partners in Iowa, while Form 1065 is used at the federal level. Each form requires detailed reporting of income and deductions, ensuring that all partners are accounted for in the tax calculation. This structure helps streamline the tax process for partnerships, making it easier for nonresident partners to fulfill their tax obligations.

Another document similar to the Iowa IA 1040C is the IRS Form 1120S, which is used by S corporations. Like the IA 1040C, Form 1120S allows S corporations to report their income, deductions, and credits. Both forms require that the income be passed through to shareholders, who then report it on their individual tax returns. The IA 1040C serves nonresident shareholders in Iowa, while Form 1120S serves shareholders at the federal level. This similarity helps maintain consistency in how income is reported and taxed across different types of entities.

The Iowa IA 1040C also resembles the IRS Form 1041, which is used for estates and trusts. Both forms enable the reporting of income generated by the estate or trust, including distributions to beneficiaries. The IA 1040C focuses on nonresident beneficiaries in Iowa, while Form 1041 is applicable at the federal level. Each form requires the attachment of supporting documents, such as K-1s, to ensure accurate reporting of income and tax obligations. This parallel allows for a streamlined process for beneficiaries receiving income from estates or trusts.

Form IA 148 is another document related to the Iowa IA 1040C. The IA 148 Tax Credits Schedule is used to report nonrefundable credits that can reduce the tax owed. Both forms require accurate reporting of credits to ensure compliance with state tax regulations. The IA 148 must be attached to the IA 1040C to provide a complete picture of the taxpayer's credits. This connection between the two forms helps ensure that taxpayers receive any credits they are entitled to while filing their composite return.

The Iowa IA 1040C is also similar to the IRS Form 1040NR, which is used by nonresident aliens. Both forms are designed for individuals who do not reside in the state or country where they earn income. The IA 1040C allows nonresident partners and shareholders to report Iowa-source income, while Form 1040NR focuses on U.S. source income. Each form provides a way for nonresidents to fulfill their tax obligations while ensuring they are taxed only on income sourced from the respective jurisdiction.

For those considering a transaction involving trailers, completing a Trailer Bill of Sale form is essential to ensure a clear transfer of ownership. This legal document, which records the sale and outlines vital details of the trailer, is crucial for both buyers and sellers. To learn more about this form and its importance in facilitating smooth transactions, visit https://billofsaleforvehicles.com/editable-trailer-bill-of-sale.

Lastly, the Iowa IA 1040 is a relevant document. This form is used by residents to report their individual income tax. While the IA 1040C is specifically for nonresidents and composite returns, both forms share similar structures in terms of income reporting, deductions, and credits. The IA 1040C is tailored to accommodate the unique needs of nonresidents, while the IA 1040 is for residents. This distinction helps maintain clarity in tax reporting for individuals based on their residency status.