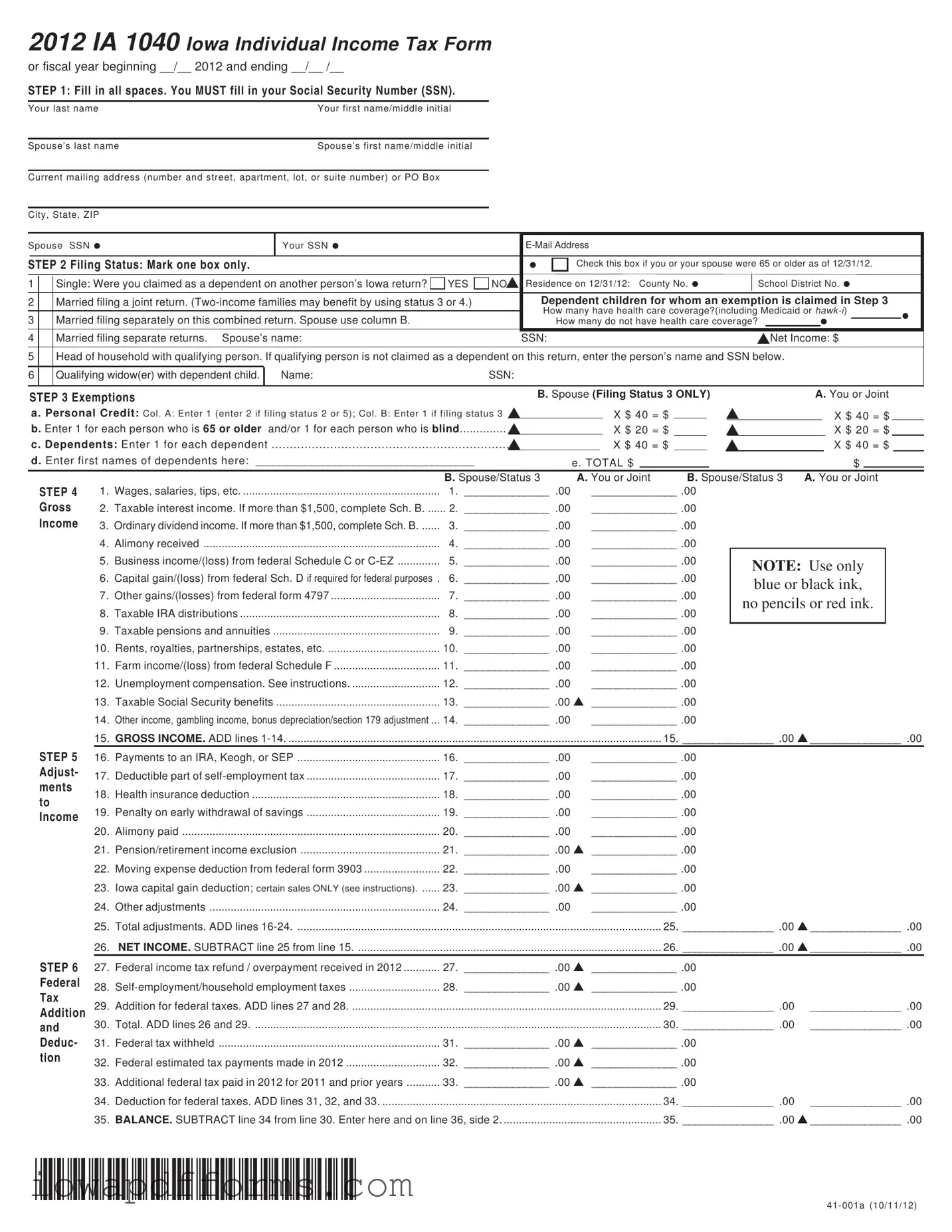

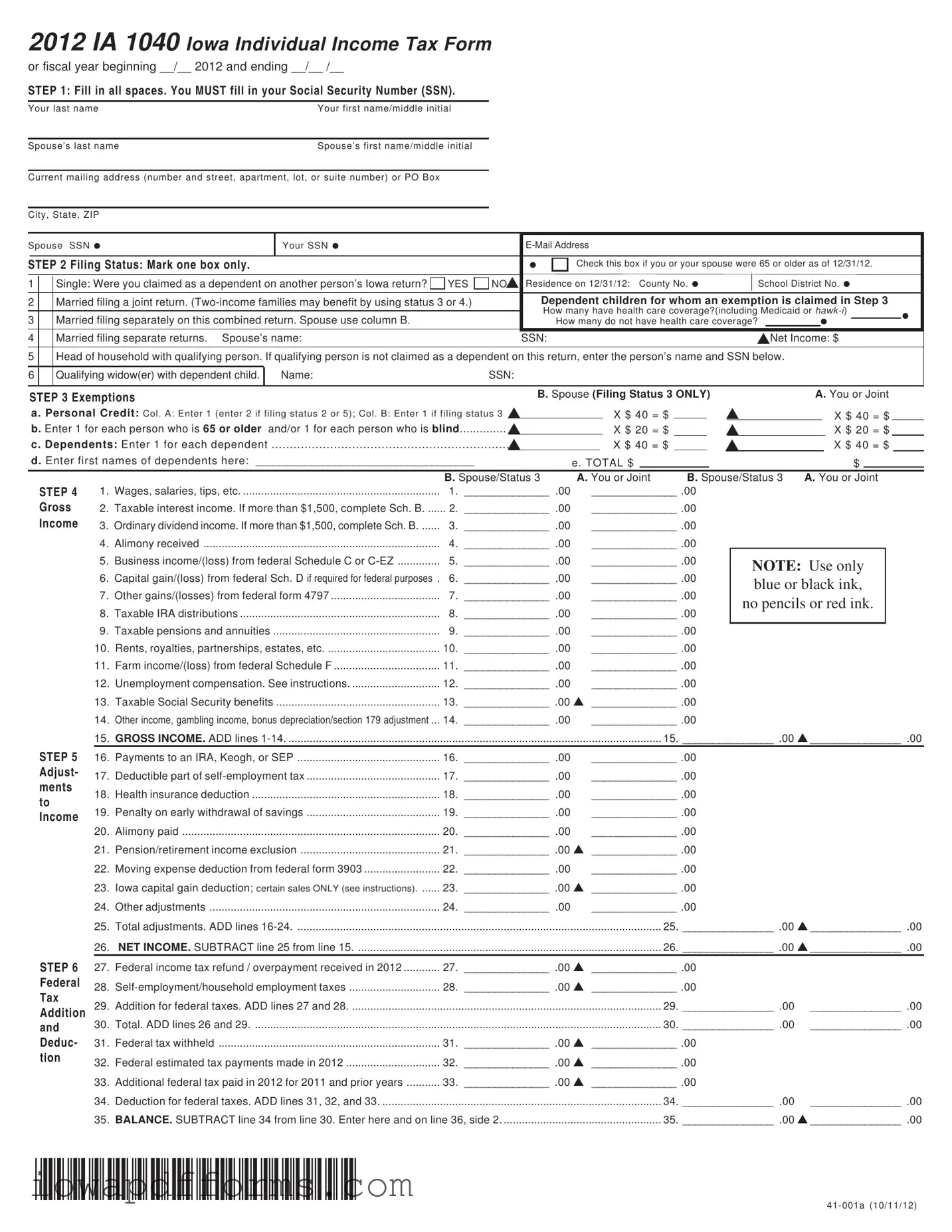

The Iowa IA 1040 form shares similarities with the Federal Form 1040, which is the standard income tax return used by individuals in the United States. Both forms require taxpayers to report their income, claim deductions, and calculate their tax liability. While the Federal Form 1040 is used for federal income tax purposes, the Iowa IA 1040 is specifically tailored for state income tax. Both forms guide taxpayers through a series of steps to ensure accurate reporting, including sections for personal information, filing status, and exemptions. This structure helps taxpayers easily navigate their tax obligations at both the federal and state levels.

Another document that resembles the Iowa IA 1040 is the California Form 540. Like the Iowa form, California Form 540 is designed for residents to report their state income tax. Both forms require similar information, such as personal details, income sources, and deductions. Taxpayers in California, much like those in Iowa, must indicate their filing status and claim exemptions for dependents. The forms also feature sections that address specific credits and adjustments applicable to their respective states, highlighting the unique tax considerations that residents must account for when filing their returns.

For those looking to understand the process of transacting an All-Terrain Vehicle, a reliable resource is the crucial ATV Bill of Sale document, which serves as a fundamental agreement in Colorado for ensuring proper ownership transfer and legal compliance.

The New York State IT-201 form is another document similar to the Iowa IA 1040. This form is used by New York residents to file their personal income tax returns. Both the IT-201 and the IA 1040 require taxpayers to disclose their income, determine their tax liability, and claim any applicable credits or deductions. They both include sections for personal information, exemptions, and various income types. Additionally, both forms are structured to help taxpayers calculate their final tax due or refund, ensuring that they comply with state tax regulations.

Lastly, the Illinois IL-1040 form is comparable to the Iowa IA 1040 in that it serves as the individual income tax return for residents of Illinois. Just like the Iowa form, the IL-1040 requires taxpayers to provide personal details, income information, and deductions. Both forms allow taxpayers to report various sources of income, including wages, interest, and dividends. Furthermore, they guide users through calculating their tax liability and any potential refund or amount owed, making it easier for residents to fulfill their state tax obligations efficiently.