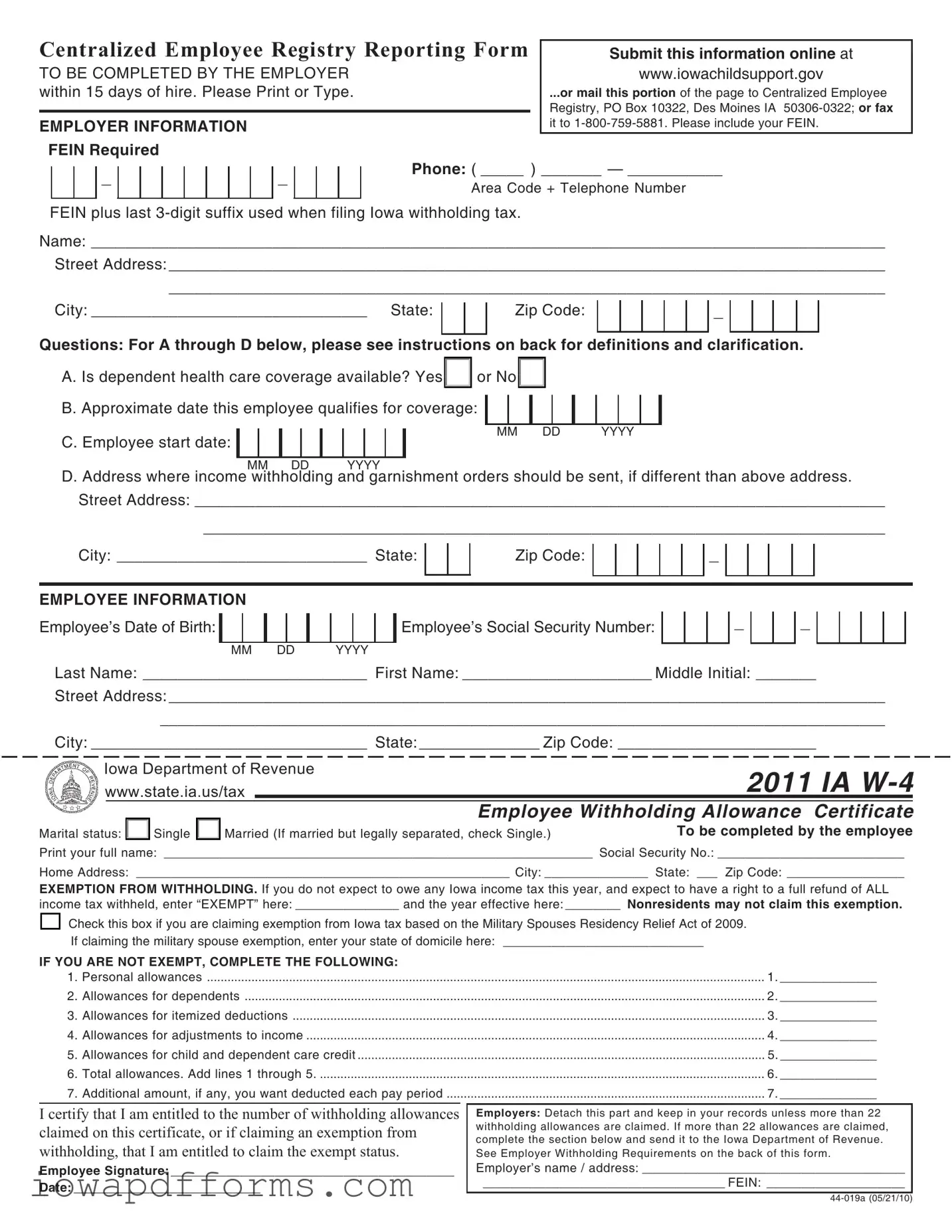

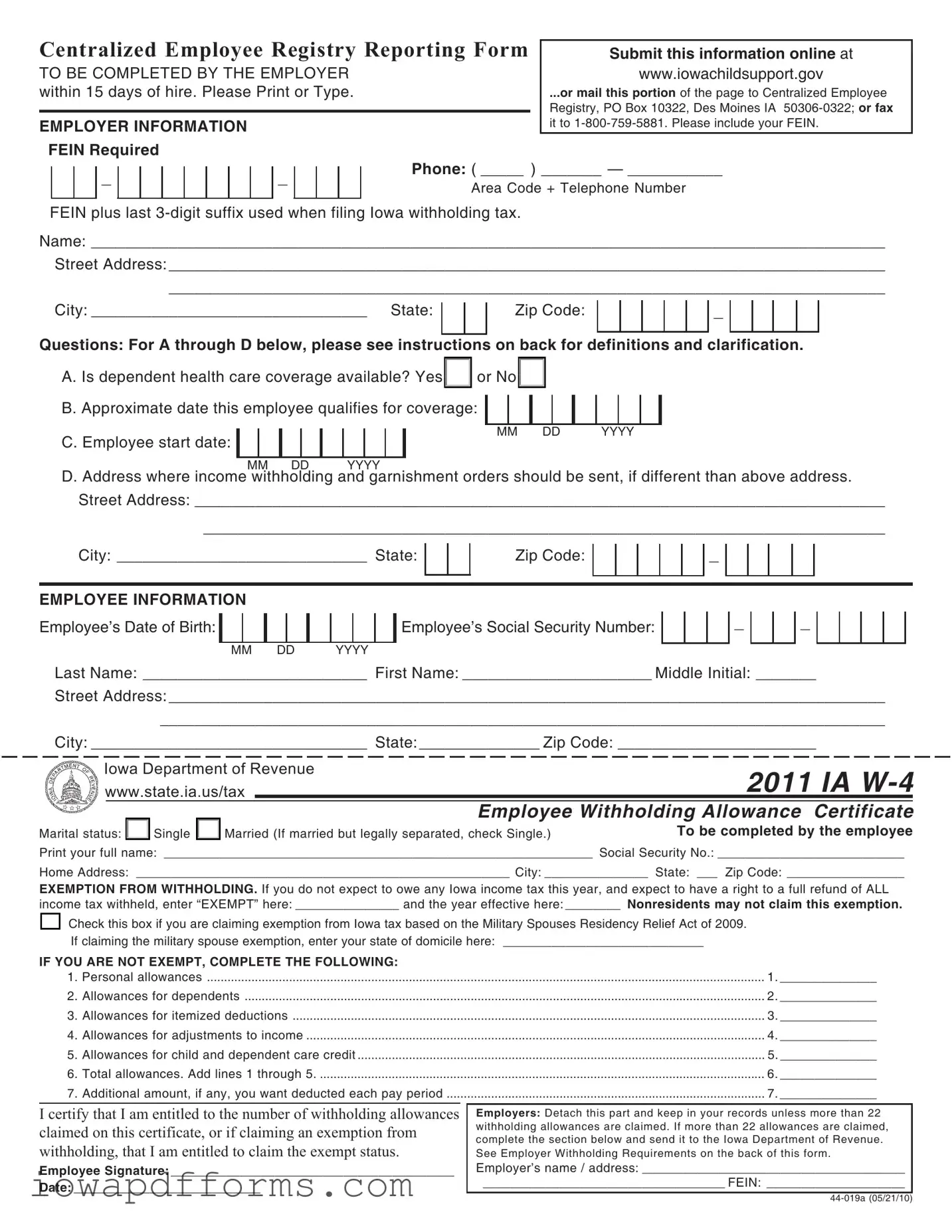

TOP PORTION OF FORM– CENTRALIZED EMPLOYEE REGISTRY REPORTING FORM – EMPLOYER REPORTING REQUIREMENTS

An employer doing business in Iowa who hires or rehires an employee must complete this section. Submit online at www.iowachildsupport.gov. You may also mail this portion of the page to Centralized Employee Registry, PO Box 10322, Des Moines IA 50306-0322; or fax it to 1-800-759-5881. Please include your FEIN. If you have questions about employer reporting requirements, call the Employers Partnering in Child Support

(EPICS) Unit at 1-877-274-2580. |

Questions A through D |

|

|

|

A. Is a family health insurance plan offered through employment? This question does not |

C. Indicate the first day for which the employee is owed |

relate to insurability of employee’s dependents. |

|

compensation. |

B. Example: Is dependent insurance coverage offered upon hire or after six months of |

D. This information is needed for income withholding and |

employment? This question does not relate to insurability of employee’s dependents. |

garnishment purposes. |

BOTTOM PORTION OF FORM – IA W-4 INSTRUCTIONS (January 1, 2011) – EMPLOYEE WITHHOLDING ALLOWANCE CERTIFICATE

Exemption from Withholding: You should claim exemption from withholding if you are a resident of Iowa and do not expect to owe any Iowa income tax or expect to have a right to a refund of all income tax withheld. If you qualify, write "EXEMPT" and the year exempt status is effective. Exempt guidelines are: (1) You are exempt if you will earn $5,000 or less and are claimed as a dependent on another person’s return, or (2) You are exempt if you will earn $9,000 or less and are not claimed as a dependent on another person’s return, or (3) married and both spouses’ total is less than $13,500. See your payroll officer to determine how much you expect to make in a calendar year. Nonresidents may not claim this exemption.

Under the Military Spouses Residency Relief Act of 2009, you may be exempt from Iowa income tax on your wages if (1) your spouse is a member of the armed forces present in Iowa in compliance with military orders; (2) you are present in Iowa solely to be with your spouse; and (3) you maintain your domicile in another state. If you claim this exemption, check the appropriate box, enter the state other than Iowa you are claiming as your state of domicile, and attach a copy of your spousal military identification card to the IA W-4 provided to your employer.

Taxpayers 65 years of age or older: You are exempt if you are single and your income is $24,000 or less or if you are married and your combined income is $32,000 or less. Only one spouse must be 65 or older to qualify for the exemption.

You must complete a new W-4 within 10 days from the day you anticipate you will incur an Iowa income tax liability for the calendar year (or your fiscal year) or on or before December 31 if you anticipate you will incur an Iowa income tax liability for the following year. If you want to claim an exemption from withholding next year, you must file a new W-4 with your employer on or before February 15.

FILING REQUIREMENTS/NUMBER OF ALLOWANCES

Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld.

1.Personal Allowances: You can claim the following personal allowances:

•1 allowance for yourself or 2 allowances if you are unmarried and eligible to claim head of household status, plus 1 allowance if you are 65 or older, and plus 1 allowance if you are blind.

•If you are married and your spouse either does not work or is not claiming his/her allowances on a separate W-4, you may also claim the following allowances: 1 for your spouse, plus 1 if your spouse is 65 or older, and plus 1 if your spouse is blind.

•If you are single and hold more than one job, you may not claim the same allowances with more than one employer at the same time. If you are married and both you and your spouse are employed, you may not both claim the same allowances with both of your employers at the same time.

•To have the highest amount of tax withheld, claim "0" allowances on line 1.

2.Allowances for Dependents: You may claim 1 allowance for each dependent you will be able to claim on your Iowa income tax return.

3.Allowances for Itemized Deductions

(a)Enter total amount of estimated itemized deductions ..................................................................................... (a) $ _________________

(b)Enter amount of your standard deduction using the following information ................................................... (b) $ _________________

If single, married filing separately on a combined return, or married filing separate returns, enter $1,830 If married filing a joint return, unmarried head of household, or qualifying widow(er), enter $4,500

(c)Subtract line (b) from line (a) and enter the difference or zero, whichever is greater.................................... (c) $ _________________

(d)Additional allowance: Divide the amount on line (c) by $600, round to the nearest whole number and enter on line 3 of the IA W-4 on other side.

4.Allowances for Adjustments to Income: Estimate allowable adjustments to income for payments to an IRA, Keogh, or SEP; penalty on early withdrawal of savings; alimony paid; moving expense deduction from federal form 3903; and student loan interest, which are reflected on the Iowa 1040 form. Divide this amount by $600, round to the nearest whole number, and enter on line 4 of the IA W-4.

5.Allowances for Child/Dependent Care Credit: Persons having child/dependent care expenses qualifying for the federal and Iowa Child and Dependent Care Credit may claim additional Iowa withholding allowances based on their net incomes. If you have qualifying child and dependent care expenses and wish to reduce your Iowa withholding on the basis of this credit, you may claim additional withholding allowances for Iowa based on the following table. Married persons, regardless of their expected Iowa filing status, must calculate their withholding allowances based on their combined net incomes. Note that if net income is $45,000 or more, no withholding allowances are allowed for the Child and Dependent Care Credit, as taxpayers with these incomes are not eligible for the Iowa Child and Dependent Care Credit.

Withholding Allowances Allowed: IOWA NET INCOME |

ALLOWANCES |

IOWA NET INCOME |

ALLOWANCES |

IOWA NET INCOME |

ALLOWANCES |

$0 - $20,000 |

5 |

$20,000- $30,000 |

4 |

$30,000 - $44,999 |

3 |

Enter the number of allowances on line 5 of the IA W-4 on the reverse side. If you are married and both you and your spouse are employed, the total allowances for child and dependent care that you and your spouse may claim cannot exceed the total allowances shown above.

6.Total: Enter total of lines 1 through 5.

7.Additional Amount of Withholding Deducted: If you are not having enough tax withheld, you may request your employer to withhold more by filling in an additional amount on line 7. Often married couples, both of whom are working, and persons with two or more jobs need to have additional tax withheld. You may also need to have additional tax withheld because you have income other than wages, such as interest and dividends, capital gain, rents, alimony received, etc. Estimate the amount you will be under-withheld, and divide that amount by the number of pay periods per year. If you reside in a school district that imposes a school district surtax, consider reducing the amount of allowances shown on lines 1-5 or have additional tax withheld on line 7.

Changes in Allowances: You may file a new W-4 at any time if the number of your allowances INCREASES. You must file a new W-4 within 10 days if the number of allowances previously claimed by you DECREASES.

Penalties: Penalties apply for willfully supplying false information or for willful failure to supply information which would reduce the withholding allowances. If you file as exempt from withholding and you incur an income tax liability, you may be subject to a penalty for underpayment of estimated tax. Employer Withholding Requirements: The employer must maintain records of the W-4s. If the employee is claiming more than 22 withholding allowances or is claiming exemption from withholding when wages are expected to exceed $200 per week, the employer must send a copy of the W-4 under separate cover within 90 days to the Individual Unit, Examination Section, Iowa Department of Revenue, P.O. Box 10456, Des Moines, Iowa 50306-0456. Questions about Iowa taxes: Call 515-281-3114 or 1-800-367-3388 from Iowa, Rock Island, Moline, Omaha, or e-mail idr@iowa.gov