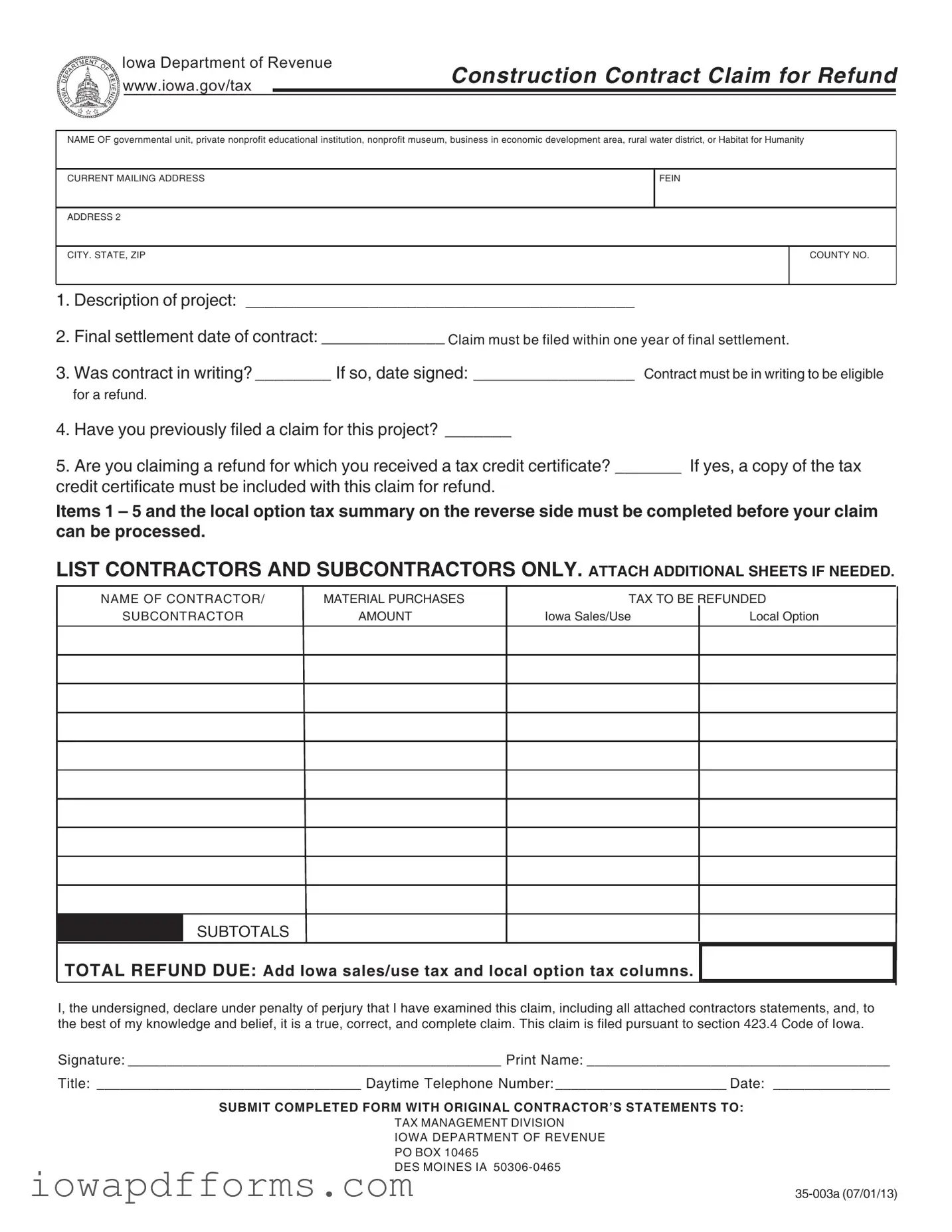

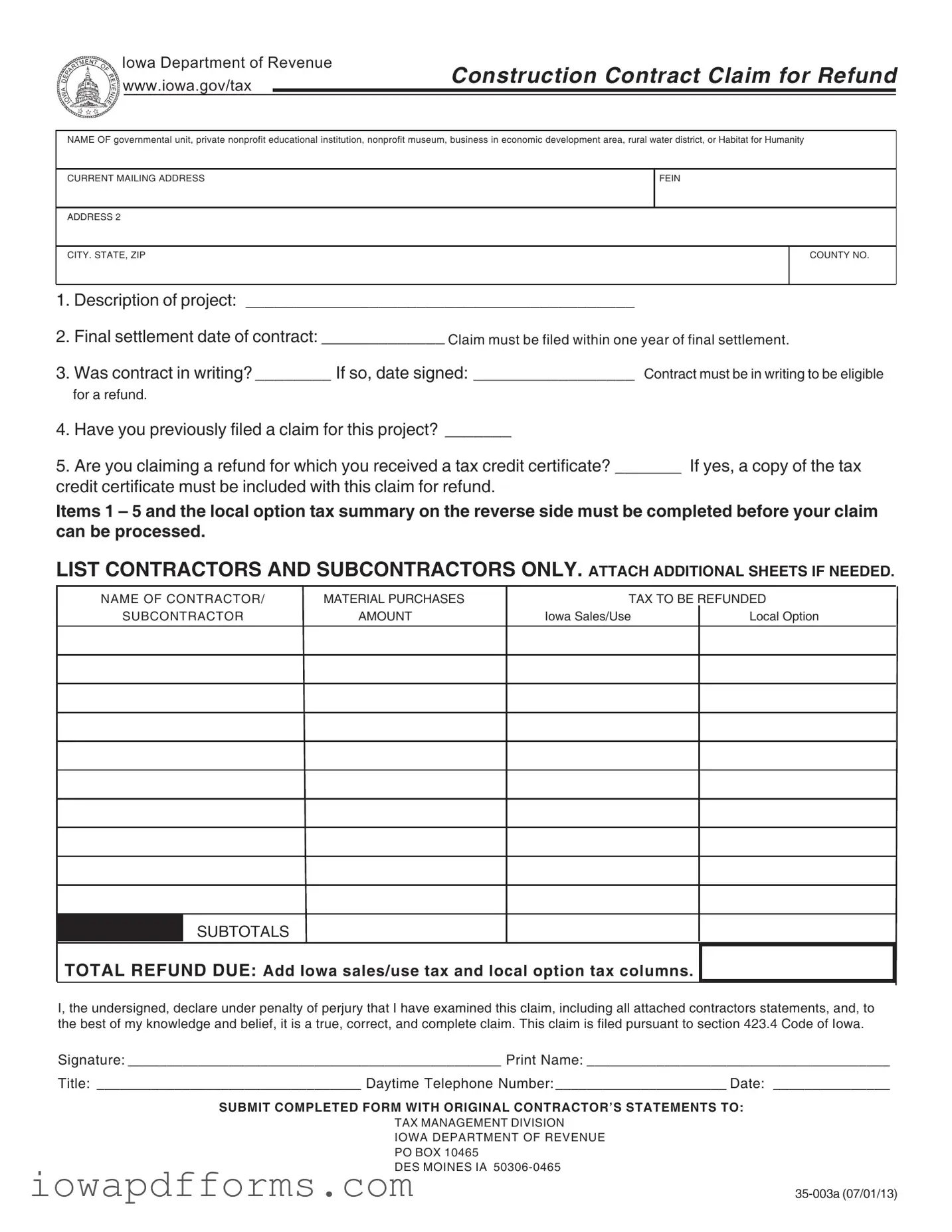

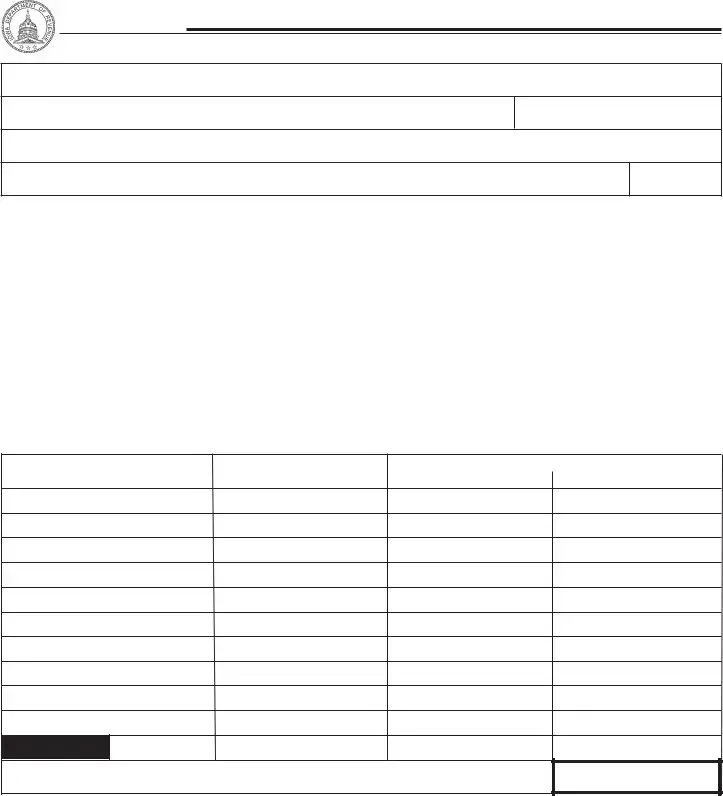

The Iowa 35 003A form, known as the Construction Contract Claim for Refund, shares similarities with the IRS Form 4506-T, which is used to request a transcript of tax returns. Both documents require specific identifying information, such as the name and address of the entity filing the claim. Additionally, each form necessitates a signature, affirming the accuracy of the information provided. The IRS form, like the Iowa form, must be submitted within a designated timeframe to ensure timely processing, emphasizing the importance of adhering to regulatory timelines.

Another document akin to the Iowa 35 003A form is the IRS Form 941, which is the Employer’s Quarterly Federal Tax Return. This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Similar to the Iowa form, it requires detailed information about the entity filing and the specific amounts involved. Both forms also necessitate the inclusion of supporting documentation to substantiate the claims made, highlighting the need for thorough record-keeping.

The Iowa 35 003A form is also comparable to the California Form BOE-401-A, used for claiming a refund of sales and use taxes. Both forms require the claimant to provide detailed information about the transaction, including dates and amounts. Furthermore, both documents mandate that the claim be filed within a specific period following the transaction, ensuring that refund requests are timely and relevant to recent activities.

Similar to the Iowa form is the New York State Form ST-101, which is the Exempt Use Certificate. This form is used by purchasers to claim exemption from sales tax on certain purchases. Both documents require a declaration of the purpose of the claim and necessitate the signature of the claimant. Each form is designed to ensure that only eligible claims are processed, thus preventing misuse of tax exemptions.

The Illinois Form CRT-61, which is a claim for refund of sales tax, also mirrors the Iowa 35 003A form in its structure and purpose. Both forms require the claimant to list specific details regarding the transaction, including contractor and subcontractor information. They also necessitate the submission of supporting documents, which must be accurately completed to facilitate the processing of the refund request.

Another document that resembles the Iowa 35 003A form is the Texas Form 01-114, used for claiming a refund of sales tax. This form requires the claimant to provide a description of the items purchased and the reasons for the refund claim. Both forms emphasize the necessity of filing within a certain timeframe, reinforcing the importance of prompt action in tax matters.

For anyone involved in the buying or selling of a trailer, utilizing a Trailer Bill of Sale form is essential to ensure a smooth transaction and to provide a clear record of the sale. This form serves as proof of purchase, detailing vital information about the trailer and the parties involved in the transaction. To create your own trailer bill of sale, you can visit https://billofsaleforvehicles.com/editable-trailer-bill-of-sale for an easy-to-edit template that suits your needs.

The Florida Department of Revenue’s DR-26 form, which is used for requesting a sales tax refund, shares several characteristics with the Iowa form. Both require detailed information about the claim, including the amount of tax being refunded. Additionally, each form must be accompanied by supporting documentation to validate the claim, thus ensuring that the refund process is thorough and accountable.

Similar to the Iowa 35 003A form is the Michigan Sales Tax Refund Request form. This document requires the claimant to provide information about the transaction, including dates and amounts. Both forms also require the claimant's signature, affirming the accuracy of the information provided. The need for supporting documents is a commonality that further aligns these two forms in their operational requirements.

Lastly, the Ohio Sales Tax Refund Request form is comparable to the Iowa 35 003A form. Both documents require the claimant to provide specific details about the transaction and the amount of tax being claimed for refund. Each form also includes a declaration of truthfulness, requiring the claimant to affirm that the information provided is accurate and complete, thus ensuring integrity in the refund process.