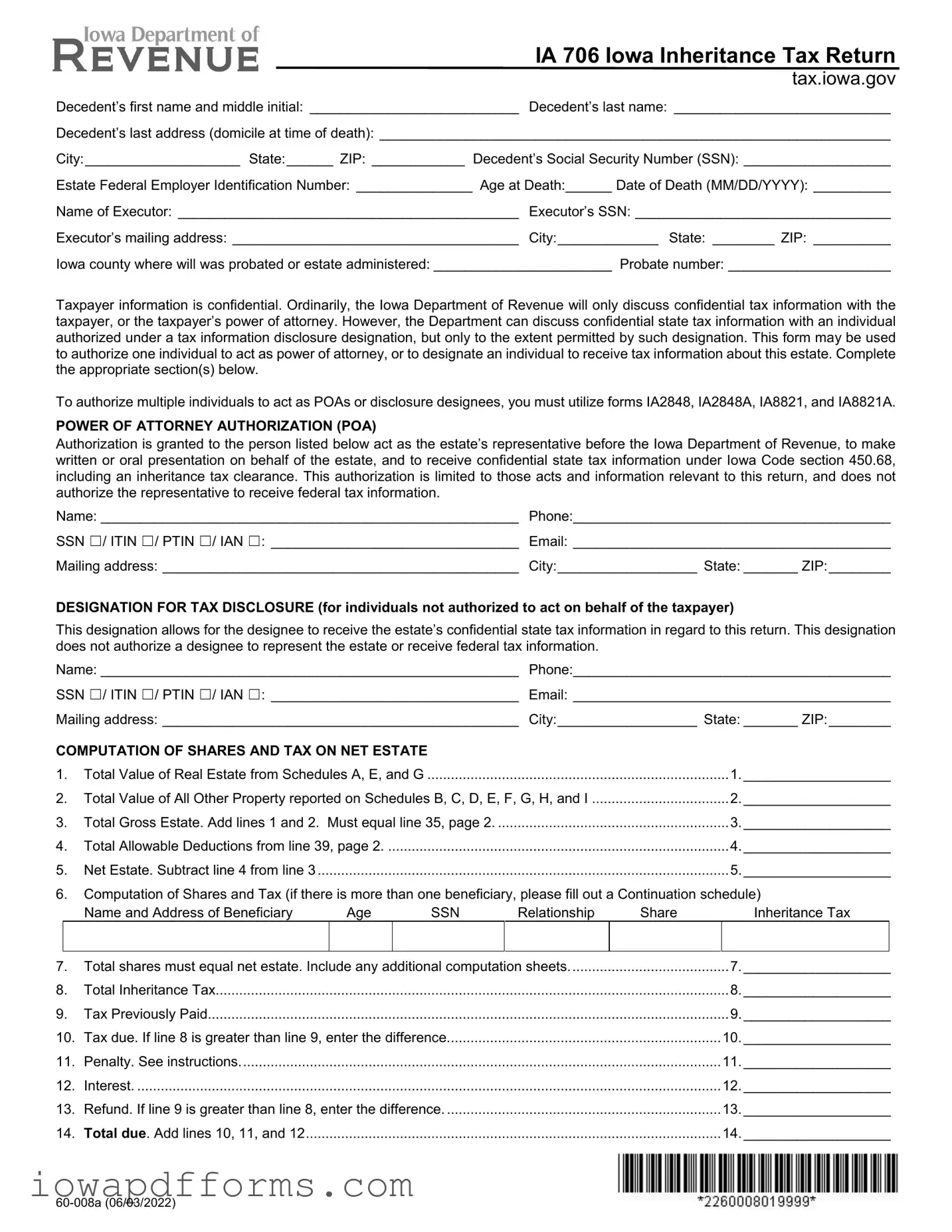

IA 706 Iowa Inheritance Tax Return

tax.iowa.gov

Decedent’s first name and middle initial: ___________________________ Decedent’s last name: ____________________________

Decedent’s last address (domicile at time of death): __________________________________________________________________

City:____________________ State:______ ZIP: ____________ Decedent’s Social Security Number (SSN): ___________________

Estate Federal Employer Identification Number: _______________ Age at Death:______ Date of Death (MM/DD/YYYY): __________

Name of Executor: ____________________________________________ Executor’s SSN: _________________________________

Executor’s mailing address: _____________________________________ City:_____________ State: ________ ZIP: __________

Iowa county where will was probated or estate administered: _______________________ Probate number: _____________________

Taxpayer information is confidential. Ordinarily, the Iowa Department of Revenue will only discuss confidential tax information with the taxpayer, or the taxpayer’s power of attorney. However, the Department can discuss confidential state tax information with an individual authorized under a tax information disclosure designation, but only to the extent permitted by such designation. This form may be used to authorize one individual to act as power of attorney, or to designate an individual to receive tax information about this estate. Complete the appropriate section(s) below.

To authorize multiple individuals to act as POAs or disclosure designees, you must utilize forms IA2848, IA2848A, IA8821, and IA8821A.

POWER OF ATTORNEY AUTHORIZATION (POA)

Authorization is granted to the person listed below act as the estate’s representative before the Iowa Department of Revenue, to make written or oral presentation on behalf of the estate, and to receive confidential state tax information under Iowa Code section 450.68, including an inheritance tax clearance. This authorization is limited to those acts and information relevant to this return, and does not authorize the representative to receive federal tax information.

Name: ______________________________________________________ |

Phone:_________________________________________ |

SSN ☐/ ITIN ☐/ PTIN ☐/ IAN ☐: ________________________________ |

Email: _________________________________________ |

Mailing address: ______________________________________________ |

City:__________________ State: _______ ZIP:________ |

DESIGNATION FOR TAX DISCLOSURE (for individuals not authorized to act on behalf of the taxpayer)

This designation allows for the designee to receive the estate’s confidential state tax information in regard to this return. This designation does not authorize a designee to represent the estate or receive federal tax information.

|

|

|

|

Name: ______________________________________________________ |

Phone:_________________________________________ |

SSN ☐/ ITIN ☐/ PTIN ☐/ IAN ☐: ________________________________ |

Email: _________________________________________ |

Mailing address: ______________________________________________ |

City:__________________ State: _______ ZIP:________ |

COMPUTATION OF SHARES AND TAX ON NET ESTATE |

|

|

1. |

Total Value of Real Estate from Schedules A, E, and G |

1.___________________ |

2. |

Total Value of All Other Property reported on Schedules B, C, D, E, F, G, H, and I |

2.___________________ |

3. |

Total Gross Estate. Add lines 1 and 2. Must equal line 35, page 2 |

3.___________________ |

4. |

Total Allowable Deductions from line 39, page 2 |

4.___________________ |

5. |

Net Estate. Subtract line 4 from line 3 |

5.___________________ |

6.Computation of Shares and Tax (if there is more than one beneficiary, please fill out a Continuation schedule)

|

|

Name and Address of Beneficiary |

Age |

SSN |

Relationship |

Share |

|

Inheritance Tax |

|

|

|

|

|

|

|

|

|

7. |

Total shares must equal net estate. Include any additional computation sheets |

|

7. |

___________________ |

8. |

Total Inheritance Tax |

|

|

|

|

8. |

___________________ |

9. |

Tax Previously Paid |

|

|

|

|

9. |

___________________ |

10. |

Tax due. If line 8 is greater than line 9, enter the difference |

|

|

10. |

___________________ |

11. |

Penalty. See instructions |

|

|

|

|

11. |

___________________ |

12. |

Interest |

|

|

|

|

12. |

___________________ |

13. |

Refund. If line 9 is greater than line 8, enter the difference |

|

|

13. |

___________________ |

14. |

Total due. Add lines 10, 11, and 12 |

|

|

|

|

14. |

___________________ |

60-008a (06/03/2022)

IA 706, page 2

15. |

Marital status of decedent at death: Married ☐ |

Widow(er) ☐ |

Single ☐ |

Divorced ☐ |

|

|

|

|

The relationship of decedent’s children to surviving spouse must be included if decedent died intestate. |

|

|

|

16. |

Were any children born to or adopted by the decedent after execution of the last will? |

|

|

Yes ☐ |

No ☐ |

|

In all cases of adoption, include a copy of the decree. |

|

|

|

|

|

|

|

|

17. |

Decedent’s occupation before death: __________________________________________________________________________ |

18. |

Decedent died: Intestate (include heirship chart) |

☐ |

Estate has trust (include trust agreement) |

☐ |

|

|

Testate (include copy of will) |

☐ |

|

|

|

|

|

|

|

|

19. |

Election of spouse. Submit copy of election: Under will ☐ |

Distributive share ☐ |

|

|

|

|

|

|

20. |

Was a disclaimer filed? If yes, submit copy of disclaimer |

|

|

|

|

Yes ☐ |

No ☐ |

21. |

Do you elect the special use valuation? |

|

|

|

|

|

Yes ☐ |

No ☐ |

22. |

Was a federal estate tax return filed? If yes, submit copy |

|

|

|

|

Yes ☐ |

No ☐ |

23. |

Do you elect to claim qualified terminal interest property (QTIP) under Iowa Code 450.3(7) and Internal Revenue |

|

|

Code (IRC) section 2056(b)(7)(B)? If yes, include copy of Schedule M of federal estate tax return |

....................... |

Yes ☐ |

No ☐ |

24. |

Do you elect to pay the federal estate tax in installments as described in IRC section 6166? |

Yes ☐ |

No ☐ |

25. |

Do you elect the alternate valuations under Iowa Code section 450.37 (IRC section 2032)? |

Yes ☐ |

No ☐ |

Summary of Gross Estate |

|

|

|

|

|

Alternate |

|

Value at Date |

Include applicable schedules only. Federal schedules may be used in place of Iowa schedules. |

Value |

|

|

of Death |

26. |

Real Estate, from Schedule A |

|

|

26. |

|

|

|

|

|

27. |

Stocks and Bonds, from Schedule B |

|

|

27. |

|

|

|

|

|

28. |

Mortgages, Notes, and Cash, from Schedule C |

|

|

28. |

|

|

|

|

|

29. |

....................Insurance on Decedent’s Life, from Schedule D. Include federal form(s) 712 |

29. |

|

|

|

|

|

30. |

Jointly Owned Property, from Schedule E |

|

|

30. |

|

|

|

|

|

31. |

Other Miscellaneous Property, from Schedule F |

|

|

31. |

|

|

|

|

|

32. |

.........................................................Transfers During Decedent’s Life, from Schedule G. |

|

|

32. |

|

|

|

|

|

33. |

Powers of Appointment, from Schedule H |

|

|

33. |

|

|

|

|

|

34. |

.........................................Annuities, Section 529 plans, and ABLE plans from Schedule I |

|

34. |

|

|

|

|

|

35. |

. ................Total Gross Estate. Add lines 26 through 34. Enter here and on page 1, line 3 |

35. |

|

|

|

|

|

Summary of Deductions – Include Schedules J and K. |

|

|

|

|

|

|

|

|

|

36. |

Funeral and Administrative expenses, from Schedule J |

|

|

|

36.___________________ |

37. |

Debts of Decedent, from Schedule K, part I |

|

|

|

|

37.___________________ |

38. |

Iowa Mortgages and Liens, from Schedule K, part II |

|

|

|

|

38.___________________ |

39. |

Total Deductions. Add lines 36 through 38. Enter here and on page 1, line 4 |

|

39.___________________ |

For the Summary of Real and Personal Property Located Outside of Iowa not included in Lines 26-34, please complete the

Summary of Real and Personal Property Located Outside of Iowa Schedule 60-011. |

|

40. Add all real and personal property items located outside of Iowa as listed on the Summary Statement |

$___________________ |

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this return, and, to the best of my knowledge and belief, it is true, correct, and complete.

Signature: _________________________________ Capacity or Title: ____________________________________ Date:__________

Preparer’s signature: ________________________ PTIN: ______________________ Phone: ________________ Date:__________

Make checks payable to Iowa Department of Revenue. When you pay by check, you authorize the Department of Revenue to convert your check to a one-time electronic banking transaction.

Mail to: Fiduciary/Inheritance Section

Iowa Department of Revenue

PO Box 10467

Des Moines IA 50306-0467